are funeral expenses tax deductible on 1041

Medical expenses of the decedent paid by the estate may be deductible on the. The IRS limits funeral deductions to.

Timely Topics For Attorneys Ppt Download

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

. If you paid the legal fees. Individual taxpayers cannot deduct funeral expenses on their tax return. They may be deducted for estate tax purposes on either a Federal or State estate tax return.

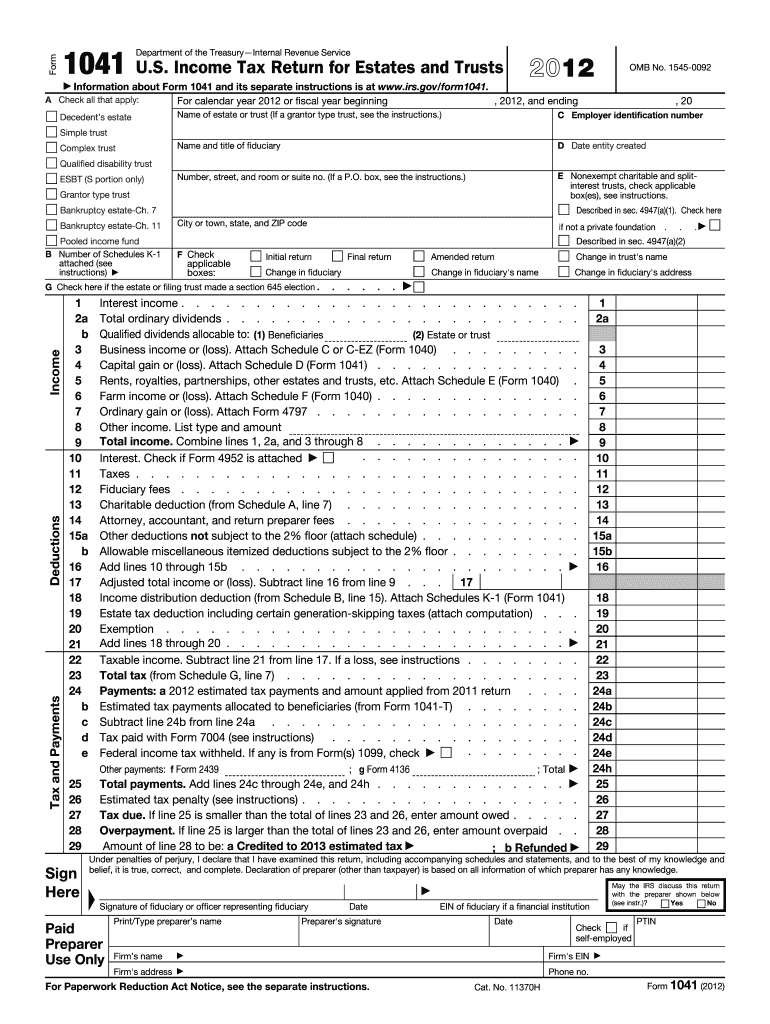

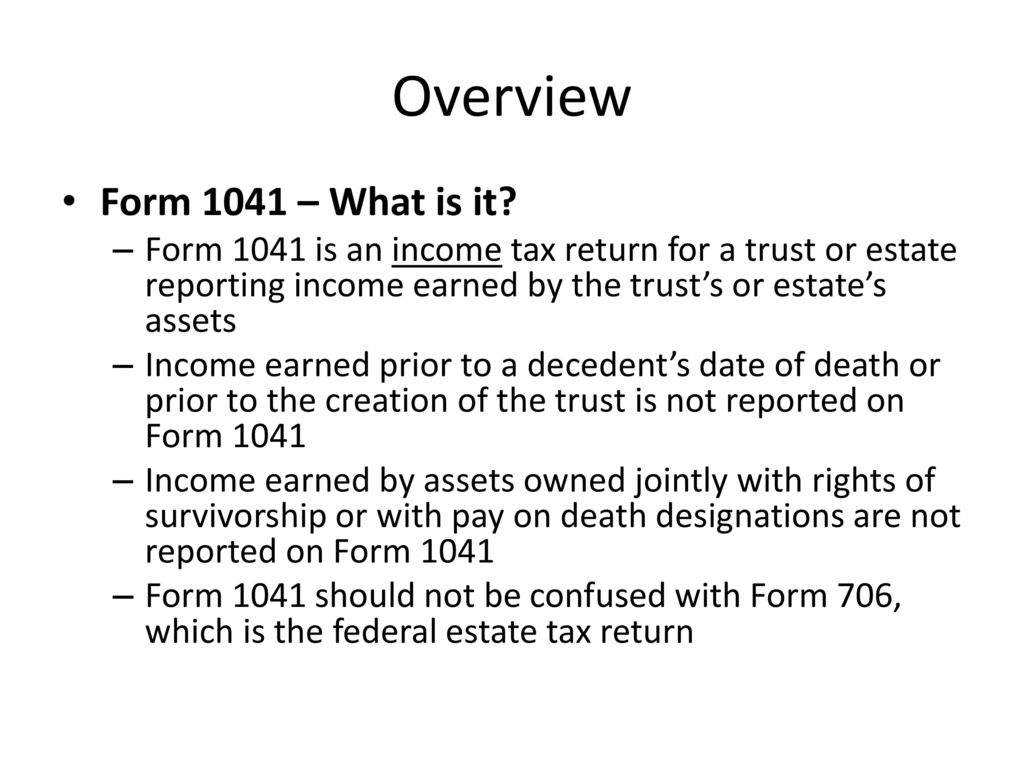

Funeral expenses are not deductible for income tax purposes. Individual taxpayers cannot deduct funeral expenses on their tax return. According to the IRS funeral expenses are only deductible on Form 706 which is a separate tax return used by an executor.

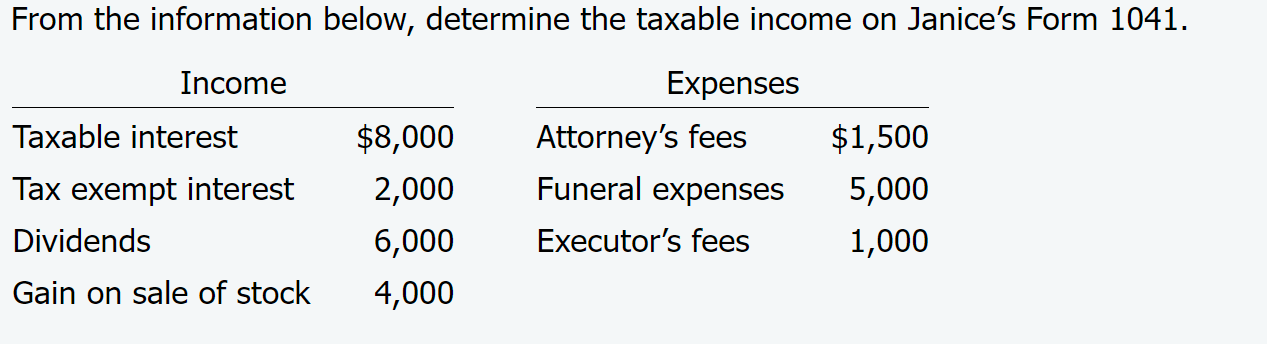

Estate income is reported on Form 1041 and this form allows your executor to claim your funeral expenses as a deduction as well. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents. There are a few exceptions.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Yes but the ordinary and necessary expenses incurred are deductible by the estate on its 1041 if one were filed. If there is an executor the Form 1041 filed under the name and TIN of the related estate for the tax year in which the election terminates includes a the items of income deduction and.

March 21 2021 827 AM The routine type of deductions are mostly self-explanatory see screenshot. Hi and welcome to our siteFuneral expenses are not deductible for income tax purposes on form 1041but may be deducted for estate tax purposes on form. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

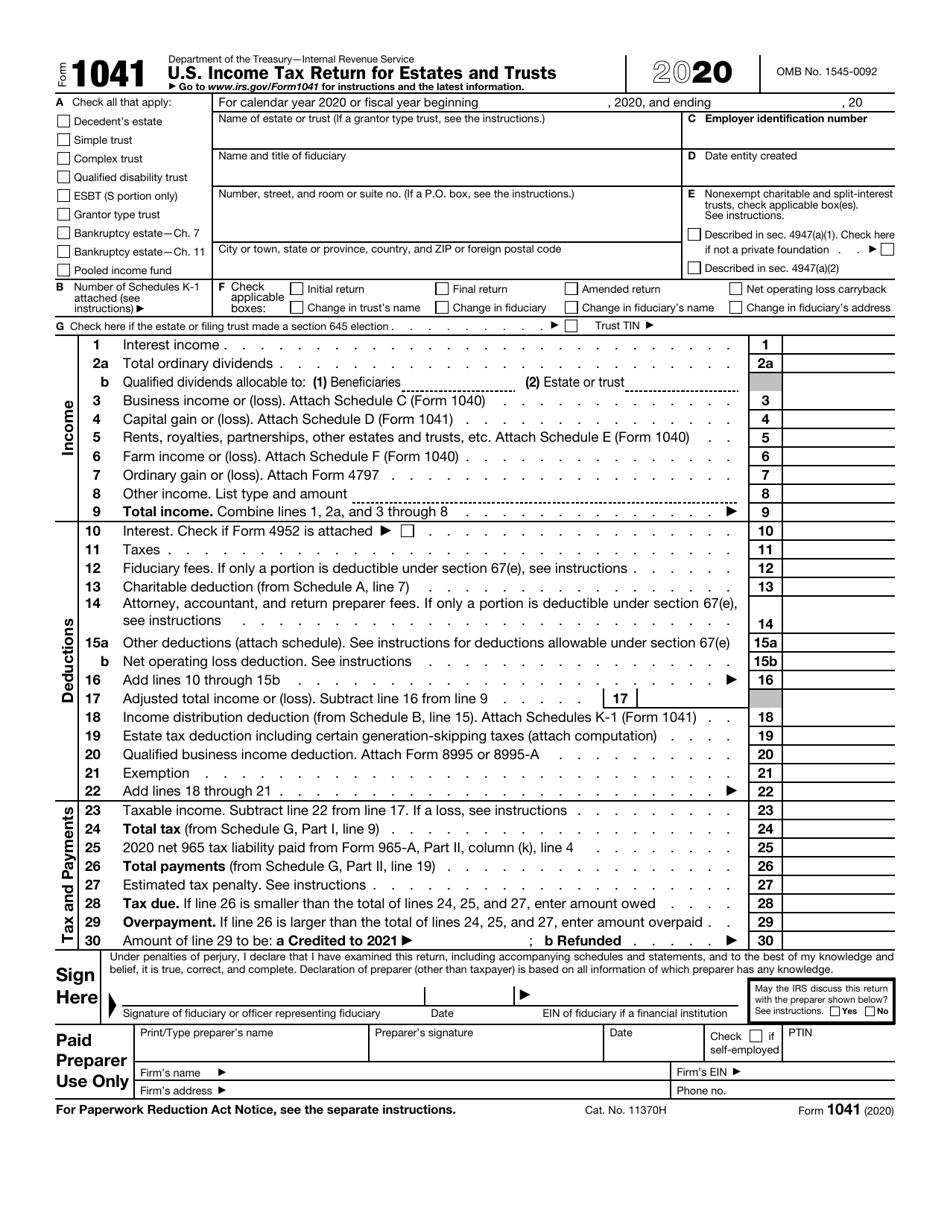

On Form 1041 you can claim deductions for expenses such as attorney accountant and return preparer fees. In short these expenses are not eligible to be claimed on a 1040 tax. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which.

These deductible expenses include. What funeral expenses are deductible on estate tax return. According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return.

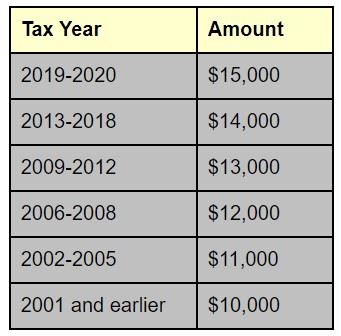

In order for funeral expenses to be deductible you would need to have. Are Funeral Expenses Deductible on Form 1041. Estates worth 1158 million or more need to file federal tax returns and only.

If the IRS requires. While the IRS allows deductions for medical expenses funeral costs are not included. However funeral expenses are simply not deductible on Form.

The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are. Regardless the executor is entitled to reimbursement. The federal government does not allow taxpayers to deduct funeral expenses on their personal income tax returns.

Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible. Legal expenses for probate are deductible but they are deductible to the estate on the estates income tax return Form 1041 if required to file them. You cant take the deductions.

Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some estates. But for estates valued above 114 million in 2019 or 1158. What expenses are deductible on estate tax return.

This means that you cannot deduct the cost of a funeral from your individual tax returns. No you are not able to claim deductions for funeral expenses on Form 1041. Yes except for medical and funeral expenses which you do not deduct on Form 1041.

Post Mortem Estate Planning Executors Elections Htj Tax

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Are Executor Fees Deductible On Form 1041

Can I Deduct Funeral Expenses For My Mother On My Tax Return Nj Com

Boca Raton Estate Tax Returns Florida Probate Law Firm

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

Irs Instructions For Form 1041 And Schedules A B G J And K 1 2017 2022 Fill Out Tax Template Online Us Legal Forms

Post Mortem Estate Planning Executors Elections Htj Tax

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Irs Form 1041 Download Fillable Pdf Or Fill Online U S Income Tax Return For Estates And Trusts 2020 Templateroller

Are Funeral Expenses Tax Deductible The Financial Guide

Fill Free Fillable Irs Pdf Forms

Tackling Tax Issues As An Estate Executor Hantzmon Wiebel Cpa And Advisory Services

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

Chapter 18 Flashcards Chegg Com

Video Guide To A Fiduciary Income Tax Return Turbotax Tax Tips Videos

10 Tax Deductible Funeral Service Costs

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp